Partnering with insurance companies to grow their agri-insurance portfolio

Cropin’s solutions solve challenges insurance companies face – risk variability, claim verification, insights into crop losses, farmer verification, plot-level insights, regional level insights, and help minimize the cost of operations by automating disbursals.

We help you adjust premiums in real-time, monitor crop susceptibility, help you pinpoint affected crops, send weather, pest and disease alerts, and identify malpractice. Grow your agri-insurance portfolio with our solution`s while reducing your claim approval process time.

Challenges plaguing the farming industry:

- Inaccurate record-keeping

- Farm & farmer profile digitization

- No transparency on farming operations or field officer productivity

- Yield irregularity & crop losses

- Harvest management

- Market linkage

Challenges plaguing seed companies:

- Grading seed varieties

- Ensuring data accuracy before the seed multiplication stage

- Seed traceability and certifications

- Demand forecasting and go-to-market

- Farmer literacy and engagement

Challenges plaguing the food processing industry:

- Ensuring adherence to PoP and produce quality

- Monitoring and tracking input usage

- End-to-end traceability of farm operations to guarantee certifications

- Alerts for pest and disease infestation

- Prevent counterfeiting of goods

Challenges plaguing agri-input companies:

- Field officer productivity

- Regional level crop analytics

- Revenue generation and profitability

- Supply chain management

- Demand forecasting

Challenges plaguing development projects:

- Farmer engagement & literacy

- Adoption of sustainable agri practices

- Strengthen certification programs for producers

- Climate-smart financing

- Impact on SDGs

- Impact on smallholder farmer income

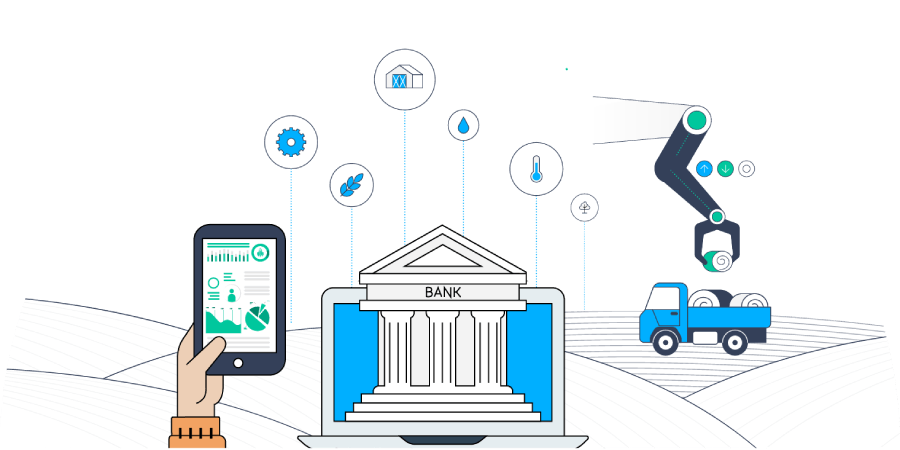

Challenges plaguing agri-lending:

- Loan disbursals, monitoring and recovery

- Meeting PSL quota

- NPA management and risk mitigation

- Preventing crop losses

- Fraudulent claims

- Market linkage

- Farmer KYC and farmer income insights

- Farm digitization

Challenges plaguing the agri-insurance industry:

- Get real-time credit and risk assessment

- Use satellite data as an alternate data source to monitor discrepancies

- Leverage historical data insights to measure yield performance at plot level

- Predictive intelligence at region, plot and crop level

- Monitor risk, adjust premiums and validate claims

Challenges plaguing the government sector:

- Field officer productivity

- Lack of insights at a regional and plot level

- Market linkage and risk mitigation

- Farmer KYC

- Yield quality and estimation

- Improving farmer income

- Driving digital transformation

Challenges plaguing the commodity trading industry:

- Crop and region or country level yield forecast

- Solve for futures & market fluctuations

- Foresight about yield and harvest at least 6 to 8 weeks in advance

- Visibility into supply chain between farms and storage

- Improve procurement by solving for farmer connect and market linkages

Solving with Cropin

Protecting insurers and growers alike – real-time risk assessment insights and crop health monitoring

Define & Adjust Premiums

Minimize Crop Losses

Digital KYC

Get Compensated Fairly

Farm, Pest & Disease Intelligence

Faster Claim Processing

Minimize Insurance Frauds

Automate Disbursals

Helping Agri-insurance companies - Insure, protect and compensate

Pradhan Mantri Fasal Bima Yojana (PMFBY) is the world’s largest crop insurance program implemented in 250k panchayats across India.

Benefits:

- Accurate smart sampling

- Crop detection

- Yield benchmarking

- Scale : 50+ districts

- Accuracy - 92%

- Crops - paddy, maize, chickpea, wheat, cotton.

Cropin developed a future-ready farming solution for Rainforest Alliance that leverages AI and satellite imagery to facilitate cocoa farmers in management and monitoring crops in a more accurate, affordable, and scalable manner.

Benefits:

- Integrated offering with structured data aggregation

- Predictive and prescriptive intelligence

- Cocoa-specific remote sensing data product

- Tripled average yields

Cropin helped Rabo Bank leverage data to understand the financial health and credit score of the cooperatives as well as identify suitable individual farmers to offer tailored loan products.

Benefits:

- Strengthen the relationship, trust & interaction between its cooperatives and growers

- Timely advisory to growers

- Improved crop quality

- Higher incomes, self-reliance, and better livelihoods

Farming for the future needs a whole new kind of power.

It's here, all together, for the very first time.

Access the power of the world's first intelligent agriculture cloud

Adaptation to climate change

Download whitepaper on how Cropin helped rural masses adapt to climate change

Expert Speak

Arindom Datta, Executive Director, Rural & Development Banking/Advisory, Rabobank